‘Let’s Get it Done – Finally’

Montage © CIBUK.Org

We are grateful to our friends at Briefings for Britain, at Bruges Group and at Brexit Facts4EU.Org for their permission to republish their articles.

The Battle for the future of Brexit Britain

INTRODUCTION

As the curtain rises on a new Parliamentary session, it’s worth reminding ourselves of one fundamental fact:

The war is NOT won. Brexit is NOT done.

In area after area, sector after sector, the UK remains within the ambit of the EU, SIX FULL YEARS after voting to leave.

With a new Prime Minister in Parliament and a new Monarch on the throne, the time has surely come to push once and for all for the fresh start and the CLEAN BREAK with the European Union which the country voted for in 2016 and endorsed again in 2019.

It is in that spirit that the CIBUK Clear Water Partnership continues to campaign, focussing on a range of outstanding issues which the government has within its power to address RIGHT NOW.

Cost of Living remains front and centre the government’s immediate priority. But even in these straitened times there is scope for bold reform including targeted tax cuts and a cull of red tape designed not only to alleviate the immediate crisis, but, crucially, to secure higher long-term growth further down the line.

Elsewhere, the Northern Ireland Protocol continues to be the nail which snags the government sweater. Bold and decisive action is required here too if the UK is to extract itself from a backstop from which it can never escape.

All of which is exacerbated by competing legal systems whose premise and ways of operating so often run counter to one another.

We have said repeatedly that time is of the essence. In addressing the challenges now facing the country, there remain two years in which to shift the proverbial mountain and provide the electorate finally with the glimpse of a better future ahead.

By campaigning hard to secure a clean break with the EU and to take full advantage of the benefits and freedoms beyond, we at the CIBUK Clear Water Partnership will continue to do all we can to try to bring that about.

SUMMARY

- We begin with the Cost-of-Living Crisis and a list of measures which the government could introduce immediately.

- Tax reform is one. Free at last from EU harmonisation, surely now the UK can exercise its new-found freedoms?

- Not before time, argues economist Catherine McBride in an article for Briefings for Britain. Scrapping VAT across a range of essential commodities including energy would be a good start.

- But only a start: zero-rated energy should merely be the gateway to a wholescale revision across the board and the pre-cursor to a much bolder, more radical vision for the future of UK Plc.

- On a similar theme for the Bruges Group, Barnabas Reynolds, senior financial practitioner at law firm Shearman & Sterling, attacks MIFID II, the EU-inspired web of cumbersome and unnecessary regulation now tying the financial services industry up in knots.

- Disagreements over red tape, however, are merely symptoms of a much deeper difference: namely the fundamental incompatibility of EU law with UK Common Law.

- Finally, while we welcome the government’s Brexit Freedoms Bill, experience tells us that warm words do not always deliver.

- To underline the point, we provide hard, statistical data courtesy of our affiliate organisation Facts4EU on just how few EU laws have been repealed so far. We will continue to monitor progress and as ever, match rhetoric against action.

VAT: an EU souvenir we should dump

By Catherine McBride for Briefings for Britain

“What better Brexit dividend could Prime Minister Truss possibly give the UK than to abolish VAT on fuel and energy?” argues Catherine McBride in an opinion piece for Briefings.

“With one blow she would give UK consumers’ spending power a boost while simultaneously putting some clear water between UK and EU taxes.”

It’s also good politics, providing a crucial display of fiscal sovereignty and making attempts to re-join the EU much harder.

Utilities

Principal recommendations include a radically revised list of zero-listed items, and not just energy (currently charged at 5%) but ALL utilities including:

“…electricity, gas, heating oil and solid fuel as well as on water supplies, sewer or drain clearing and maintenance and the emptying of cesspools and septic tanks.”

But this would be just the tip of the iceberg.

Communications

“As more people work from home, mobile phones and Wi-Fi connections have become part of our lives, so we should also remove VAT on communications services.”

Other items

Other zero recommended items include energy saving materials, mobility aids for the elderly, carry-cots for new-born babies and health aids such as nicotine patches which may nudge people into healthier ways of living and save money through prevention rather than cure.

Cutting Bureaucracy

The present system for VAT is expensive, time-consuming, and self-defeating.

“Capping energy bills on the one hand whilst charging VAT and Climate Change Levy (CCL), makes no sense at all.”

Conclusion

Not only is the present system inefficient and unjust, but there is an economic imperative too:

“Cutting VAT on essentials and removing environment levies won’t solve all of our problems. But it would lighten the load for consumers and hopefully keep them spending, which will help businesses. Without this load lightening, we will be in a recession – or a deeper recession.”

The full, original article can be found here

Moving on From EU Law – Good for the Economy, Good for Business!

By Barnabas Reynolds for the Bruges Group

In like manner, Barnabas Reynolds, partner in law at Shearman & Sterling advocates a similar legal bonfire of the regulations now that we are outside the EU’s jurisdiction.

As things stand however the UK’s financial sector, critical to its overall economic performance, remains entangled in EU regulation.

“To take one example, financial businesses have to comply with MIFID II, or to give it its full name, the Markets in Financial Instruments Directive No 2. In MIFID II, there are 1.7 million provisions, addressing matters as diverse as day-to-day conduct requirements for firms, how they should treat their customers, conflicts of interest and how exchange platforms should operate.”

As the author makes clear, the sheer complexity of the legislation is down to EU law itself which

“was conceived in legislative text – code – designed to cover all eventualities, yet static at the point of conception. Its method brings the necessity for ongoing and heavy adjustment, by iteration, largely through legislative accretion, rarely subtraction.”

By contrast

“The normal approach to law in our common law system, involving a nuanced interpretation of clear rules, carefully drafted, in a manner which leads to sensible results, is often is often not possible.”

Inferior Code

“Such an approach depends on our common system of legal reasoning, used by the courts, the government and industry alike. The EU’s rules do not allow for such clarity, instead relying on an interpretative approach which requires both regulators and industry to follow through the purposes of the code-makers, yet without much of an indication of what those purposes actually were.”

No wonder the UK has experienced so many difficulties with the EU down the years: both parties attempting to reconcile mutually exclusive legal systems.

The full original article can be found here

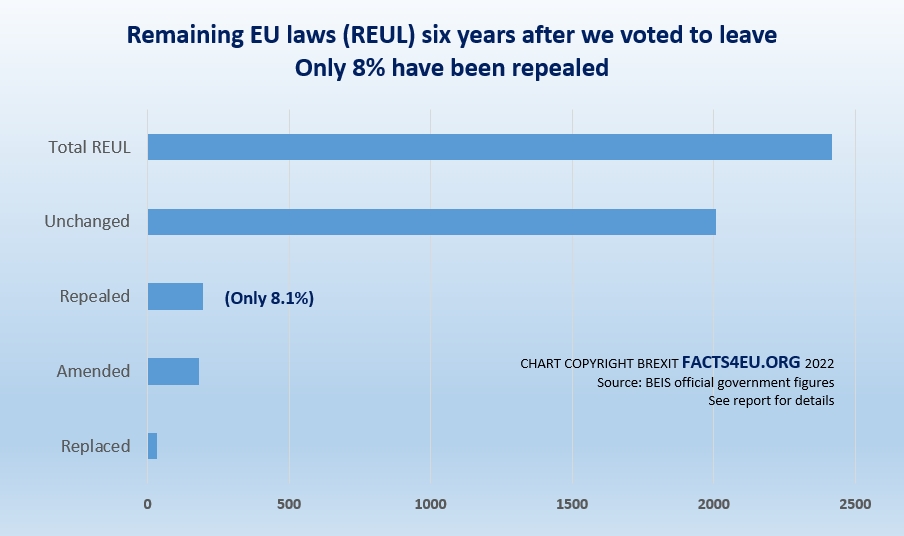

Six years after the vote to Leave, only 8% of EU laws have been repealed

We are indebted to our affiliate, Facts4EU, for their meticulous research in providing hard data illustrating the extent to which the UK remains embroiled within the EU regulatory system.

We are indebted to our affiliate, Facts4EU, for their meticulous research in providing hard data illustrating the extent to which the UK remains embroiled within the EU regulatory system.

The Brexit Freedom Bill promises a bonfire of EU regulation. The pledge, announced by Business Secretary Jacob Rees-Mogg in Parliament last Thursday is impressive.

“Now that the UK has regained its independence, we have a fantastic opportunity to do away with outdated and burdensome EU laws, and to bring forward our own regulations that are tailor-made to our country’s needs.

“The Brexit Freedoms Bill will remove needless bureaucracy that prevents businesses from investing and innovating in the UK, cementing our position as a world class place to start and grow a business.”

– The Rt Hon Jacob Rees Mogg MP, Business Secretary, 22 Sept 2022

As ever we will judge the Bill and its subsequent Act, on its merits.

The size of the problem inherited from the EU

The scale of the challenge now facing the UK can be seen in what has so far been achieved and what remains to be done:

“Retained EU Laws” (REUL)

Breakdown of what has been done so far

- Unchanged : 2,006

- Amended : 182

- Repealed : 196 (Only 8.1%)

- Replaced : 33

© Brexit Facts4EU.Org 2022 – click to enlarge

[Source : Official UK Government figures from BEIS, as at 24 Sept 2022.]

CONCLUSION

These bare statistics illustrate the scale of the task now confronting the government. It is hoped the Brexit Freedom Bill will be as good as its word. After so many promises many remain to be convinced. We are, however, reassured by the words of former Brexit minister David Jones MP:

“Once enacted, the Bill will accelerate the process of clearing this legislative gunk out of the British legal system and replacing it with homegrown laws better suited to the UK’s own business, environmental and consumer needs.

“Creating a sunset date of 31st December 2023 will concentrate the minds of officials on getting on with the job of assessing the benefits or otherwise of retained EU law. Without it, it is more than probable that the necessary clear-out would never happen.”

– The Rt Hon David Jones MP, 24 Sept 2022, exclusive to Facts4EU and CIBUK

The full article can be found here with a link to the original below:

https://facts4eu.org/news/2022_sep_axing_eu_laws