CLEAR WATER BULLETIN – EU Ties that Bind – The Case for Deregulation

Montage © CIBUK.Org

We are grateful to our friends at Briefings for Britain and Facts4EU.Org for their permission to republish the following articles.

INTRODUCTION

Their policy on tax cuts may have been shredded, but on behalf of Clear Water CIBUK we profoundly hope the government’s commitment to cutting EU red tape does not go the same way.

One of the Brexit dividends we were repeatedly promised was the freedom to make and unmake our own laws. Retained EU Law has already sat on the Statute Book for far too long and we have been promised that its special status will be abolished on 31st December 2023.

We will scrutinise progress of the Bill through Parliament and continue to hold the government to account on its promise, despite the political pyrotechnics currently exploding above our heads.

Moreover, in making the case for deregulation where it acts as an impediment to strong, sustainable economic growth, we will do so against two essential criteria:

- Is it proportionate to the size of the market participant and the associated risk?

- Does is it maintain and develop both competitive and safe markets?

SUMMARY

- In that spirit, we begin with an article in last week’s Telegraph by Barnabas Reynolds, Partner at Law with Shearman & Sterling.

- If the UK is ever to escape its political and financial strait jacket, de-regulation is not just desirable but essential.

- UK Common Law, with its emphasis on pragmatism and clearly drafted rules is a far better vehicle for achieving that objective than the top-down, restrictive Napoleonic Code used by the European Union.

- But, he says, there is no time to lose. We need to get on with it now, ‘political weather be damned.’

- That may not be so easy, according to Stefan Boscia at CityAM who casts some doubt over the UK’s ability to deliver its post-Brexit changes to EU financial services regulations amid the current government turmoil.

- Changes to aspects of EU financial law including Solvency II rules for Insurers and tweaks to the EU’s MiFID II requirements for investment firms may now be delayed owing to recent political upheavals.

- Finally, and on a more upbeat note, we are delighted to publish a summary report from our affiliate, Facts4EU.Org, on the rude health of British exports to the EU which continued to rise in the first six months of 2022, in marked contrast with the EU whose balance of trade with the rest of the world fell off a cliff.

- Thanks to meticulous and dedicated research, and in marked contrast to much of the mainstream media, we are pleased to report on the UK’s multitude of achievements in relation to its dealings with the EU and we will continue to do so wherever appropriate.

A U-turn on ripping up EU red tape would be disastrous for Truss and Britain

By Barnabas Reynolds for the Telegraph

Reformulation of our entire inherited EU legal code could prove an economic game-changer for the UK according to Barnabas Reynolds, “powering business and providing new opportunities and sources of income.”

And in marked contrast to the mini-budget, government objectives in this area appear to be clear:

“The outcome of the Prime Minister’s programme will be a simpler, clearer and more “intuitive” – easy to grasp – regime, so long as we put in the work up front to identify and excise those rules and methods which are at odds with our system.”

Speed too is of the essence:

“To succeed, government departments, our regulators, businesses and consumer groups will need to embrace the opportunity and engage with it in the spirit of change. We need to work swiftly to strip out unnecessary red tape and produce a system which applies our techniques to the modern world.”

This will require a step-change in performance from those in charge to drive the necessary changes through but it is possible and will be worth it:

“The benefits of higher growth and greater economic activity resulting from such steps can be obtained relatively cheaply. The Prime Minister is right to seize the moment to act. If the work starts now, we can begin to reap the full benefits of our traditional legal methods from the end of 2023.”

De-regulation is not an optional extra: it is the very spur to competition. And competition in turn is the key to growth and productivity.

The full article can be read below with a link to the original here:

A U-turn on ripping up EU red tape would be disastrous for Truss and Britain (telegraph.co.uk)

Uncertainty over timing of UK announcement of Big Bang 2.0 financial services reforms

By Stefan Boscia for CityAM

“There is now uncertainty over when the UK will unveil its post-Brexit changes to EU financial services regulations amid the current government turmoil,” according to a report in Monday’s CityAM.

The report goes on:

“The Treasury said last month that former chancellor Kwasi Kwarteng would announce the long-awaited reforms, which will include changing the EU’s Solvency II directive on insurance firms, in October.

This target may now slip and there is internal Treasury discussion over whether to outline the changes in new chancellor Jeremy Hunt’s Medium Term Fiscal Plan on 31 October or at a later date.

A Treasury source told City A.M. that the past week’s upheaval, which has seen Jeremy Hunt appointed as chancellor and then completely overturn the UK’s economic policy, means finding a date for the announcement has not been “an immediate priority”.

All eyes will be on the Chancellor when he announces his fiscal statement on 31st October. Any hint that the scope of ambition outlined in the financial services reform package are to be watered down will be vigorously opposed. We will continue to monitor developments and report back accordingly.

The full report can be read below or in the link provided here:

Uncertainty over timing of UK Big Bang 2.0 financial services reforms (cityam.com)

EXCLUSIVE : Brexit Britain’s exports to the EU are up 62% already this year

By CIBUK and its affiliated organisation Brexit Facts4EU.Org

Finally some good news. In spite of the ties that still bind us, the EU’s latest balance of trade figures with the rest of the world provided a shot in the arm for the UK. For the EU, alas, the figures represented a shot in the foot.

The summary figures in the following two tables tell their own story.

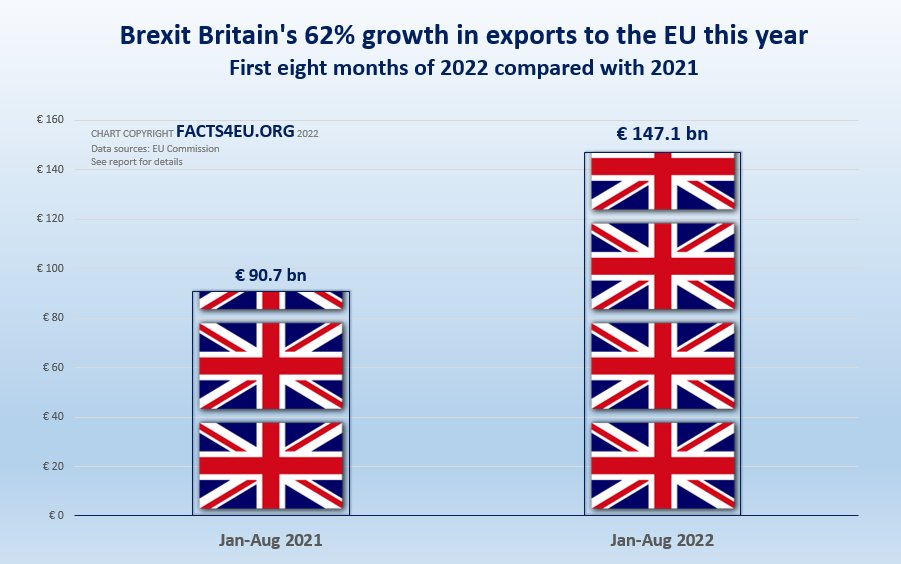

1. UK’s exports to the EU, Jan-Aug 2022

- Jan-Aug 2021 : €90.7bn

- Jan-Aug 2022 : €147.1bn

- Increase this year : + 62.2%

[Source: EU Commission’s official statistics agency, 14 Oct 2022.]

© Brexit Facts4EU.Org 2022 – click to enlarge

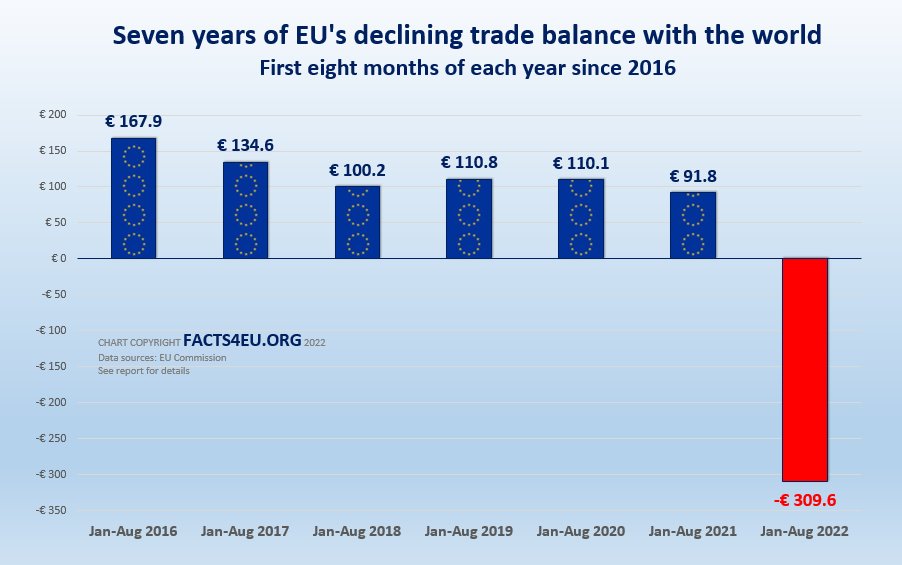

2. EU’s worsening trade balance with the rest of the world

- Jan-Aug 2016 : € 167.9

- Jan-Aug 2017 : € 134.6

- Jan-Aug 2018 : € 100.2

- Jan-Aug 2019 : € 110.8

- Jan-Aug 2020 : € 110.1

- Jan-Aug 2021 : € 91.8

- Jan-Aug 2022 : – € 309.6

[Source: EU Commission’s official statistics agency, 14 Oct 2022.]

© Brexit Facts4EU.Org 2022 – click to enlarge.

“This is an important piece of research from CIBUK and its affiliate Facts4EU.Org, and it would be good if the mainstream media caught up with it.

“Both before and after the referendum, we were told that UK trade with the EU would be irretrievably damaged by our departure. That has now been comprehensively debunked. UK exports to the EU are up strongly. At the same time, the EU’s external trade balance is collapsing alarmingly.

“The findings confirm that the UK never had any reason to doubt its own ability to thrive outside the EU, and that the British people made absolutely the right decision when they voted to leave.”

– The Rt Hon David Jones MP, speaking to our Chairman, Sun 16 Oct 2022

For the original version of this article, click here: https://facts4eu.org/news/2022_oct_brexit_boost

Please support our work