“Depressed, devalued and in debt – your CIBUK lifts the lid on the EU economy”

CIBUK Newsletter, 5th June, 2023

With its ailing currency, shrinking economy and mountainous debt, it should be obvious to all but the most blinkered that the EU economy is in a parlous state.

Yet according to our opponents re-joining the EU remains the UK’s one and only route to success. To which one can only add – if this is success, what on earth does failure look like?

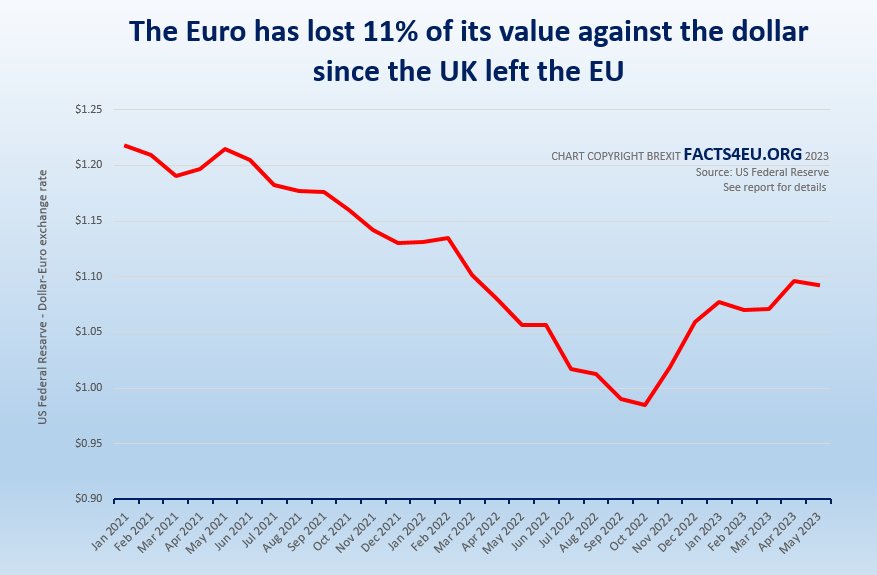

It’s one thing to persuade a nation to surrender its currency in favour of a stronger one inside a thriving trading block. But with the euro falling against the dollar, and the eurozone bingeing on debt-fuelled growth under the guise of net-zero investment, those who continue to advocate this policy must take the British people for fools.

We are indebted to our research-based affiliate Brexit Facts4EU for the following three reports – based as they are on incontrovertible and meticulously researched facts.

To those by contrast who wish to re-join the EU we invite them to consider the following:

- If you want to re-join the EU you will have to lose the Pound and sign up to the euro.

- The UK would once again assume joint-liability for the EU’s combined debts.

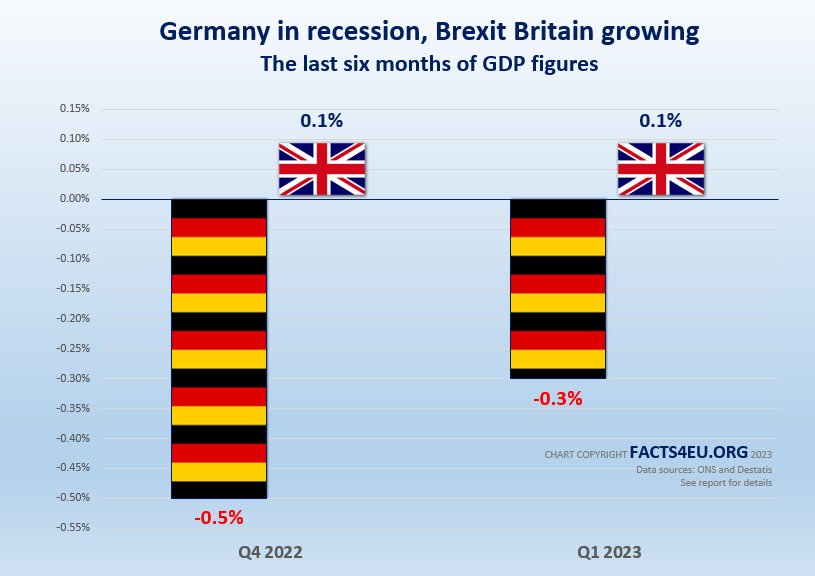

- To cap it all, latest figures indicate Germany is in recession and the UK is not.

It is vital we circulate these findings among as many of our readers and subscribers as we can.

We thank you for your attention and urge you in turn to pass these reports on.

To assist us in our cause, we ask for your support

CIBUK Documentary – Appeal for Funds

As you know, our last newsletter was devoted to the promotion of a TV-style documentary, urging the government to go much further and faster in making the case for the full Brexit we all voted for and to enable us to chart a vision for a post-Brexit Britain which millions can endorse.

As you know, our last newsletter was devoted to the promotion of a TV-style documentary, urging the government to go much further and faster in making the case for the full Brexit we all voted for and to enable us to chart a vision for a post-Brexit Britain which millions can endorse.

The response we have received to our crowd-funding initiative has been magnificent and on behalf of everyone at CIBUK I would like to thank all those who have given so generously in helping fund the forthcoming film.

Our appeal however has not yet reached its goal. We therefore need to keep going in order to deliver the strongest possible instruction to those in government to complete the task they were elected on in 2019.

With your help we can do so.

It is with great humility therefore that I ask you to give, or continue to give, as generously as you can to our cause.

The message we wish to deliver is clear. The Referendum result must be honoured in full – no ifs, no buts, no maybe’s.

By clicking on the link here, you can play your part in helping to secure this country’s future. It is as fundamental as that.

Rejoiners – if you want to go back into the EU you have to lose the Pound

Those who wish us to re-join the European Union will have to address three issues.

- Surrendering the pound and signing up to the euro is a pre-condition for re-joining the European Union. In the words of the ECB ‘adopting the euro is an important step of EU membership.’

- In doing so the UK would be jettisoning one of the strongest and most endurable currencies in the world. After the dollar, the euro and the yen, Pound Sterling is the fourth most-held reserve currency around the world.

- Why would one trade in a currency which has been in existence for around 800 years for a half-baked single currency which is in existential crisis and has lost 11% of its value against the dollar since the UK left the European Union?

To access the article in full, click on the link here

If the UK were to rejoin, the liabilities from losing the pound would be enormous

But don’t take our word for it. We quote verbatim from a speech which EU Commission President Ursula Von de Leyen delivered at the headquarters of the European Central Bank (ECB) in Frankfurt last month on the ‘European Green Deal’ – the EU’s plan for transitioning from fossil fuels to renewables.

Europe’s ‘green and glorious future’

“We have started issuing green bonds worth EUR 250 billion as part of NextGenerationEU. This makes us the largest issuer of green bonds in the world. Now we must stay the course to ensure that Europe delivers on its collective commitment to a sustainable future. And the ECB is of course playing its part – from assessing financial risks related to climate change, to greening monetary policy operations, and helping to scale up green finance.”

That alone should set the alarm bells ringing. How often have we heard European figures issue grand and expensive proclamations without the least regard to the cost and consequences for the European taxpayer?

Reality Check

Respected independent economist and banking expert, Bob Lyddon exposes the reality of this latest initiative:

“NetZero is a flag-of-convenience under which to fly this debt-fuelled public spending, because it lends a cloak of respectability and virtue to what the EU has to do anyway: borrow and spend €500 billion per annum to retain some appearance of economic growth and to fund the transfers of wealth between different members of the Eurozone, without which the strains caused by adherence to Eurozone rules would be unmanageable.”

Full details of the EU Commission President’s speech and our affiliate’s assessment of it can be read in full here.

Germany is now in recession, Brexit Britain is growing

Latest figures show the UK economy is doing better than the EU’s biggest and finest.

The data is striking and unambiguous. While Germany has been in recession for the past two quarters, the UK economy has continued to grow.

Facts speak louder than Forecasts

Commenting, Ben Philips, Communications Director for CIBUK said: “Not for the first time, the IMF’s credibility has been called into question after it was forced to dramatically revise its economic growth forecast for the UK upwards by 0.7% having predicted in April that it would contract. Their original forecast was -0.3%. In fact the UK economy grew by +0.4%. That’s the difference between recession and growth.

While bodies such as the Treasury, the OBR and the IMF specialise in forecasts, CIBUK and its affiliates prefer to rely on facts.”

A full link to the article can be found here.

As ever we maintain a watching brief.

CIBUK thanks its Affiliated Organisation, Brexit Facts4EU.Org for their research and permission to republish this article.

Main image : montage © CIBUK.Org 2023